Table of Contents

Key Takeaways

- The implementation of the Goods and Services Tax (GST) in India has opened up numerous opportunities for project ideas.

- One potential project idea is to develop a GST compliance software that helps businesses manage their tax obligations more efficiently.

- Another idea is to create an online platform that provides comprehensive information and resources on GST for businesses and individuals.

- Developing a mobile app that allows users to calculate their GST liabilities and file their returns could also be a valuable project idea.

- Creating a training program or workshop series to educate businesses and professionals on the intricacies of GST could be a beneficial project.

- Designing a system that enables seamless integration between different accounting software and GST portals could greatly simplify the tax filing process for businesses.

- Developing a platform that connects businesses with GST experts and consultants could help them navigate the complexities of the tax system more effectively.

- Creating a tool that automates the generation of GST invoices and tracks their status could be a valuable project idea for businesses.

- Designing a website or app that provides real-time updates and news on GST changes and updates could be a useful resource for businesses and individuals.

- Overall, the implementation of GST in India has created a demand for innovative project ideas that can help businesses and individuals navigate the tax system more efficiently.

GST (Goods and Services Tax) is now a part of India’s taxation system. Businesses are working on projects to make it easier to calculate taxes, manage invoices and track compliance.

A GST calculator app can help with calculations and generate reports. Automating the process saves time and reduces errors.

An invoice management system that follows GST guidelines can automate invoice generation and track payments. It simplifies billing processes and ensures compliance.

A compliance tracking software can also be useful. It can monitor compliance status with data sources like sales records, purchase orders, and inventory management systems. Alerts can be sent for potential non-compliance issues and suggest corrective measures.

Implementing GST projects? Make taxes and headaches go hand in hand! Start brainstorming these project ideas today and unlock new business success possibilities!

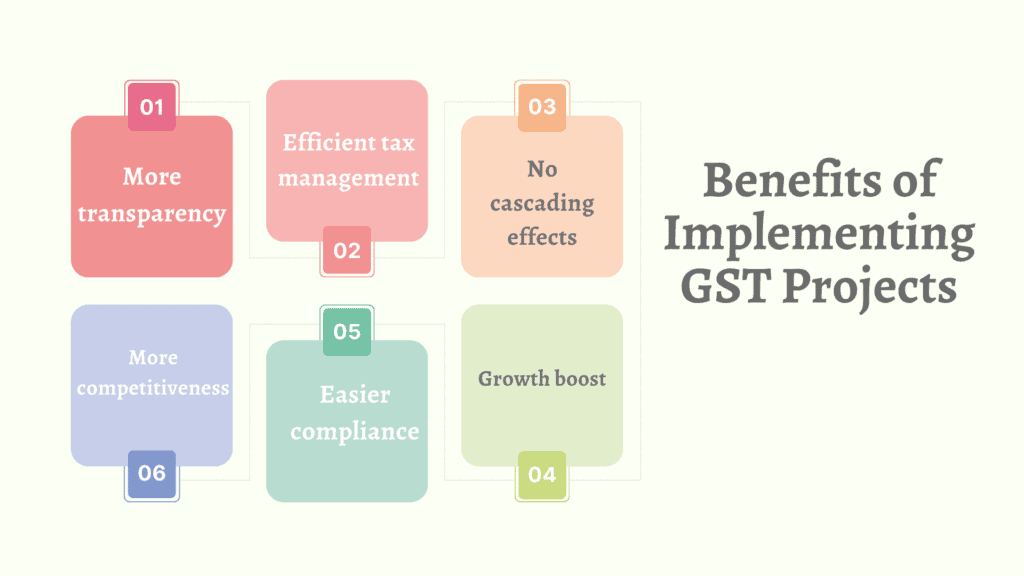

Benefits of Implementing GST Projects

GST projects have many advantages for companies and the economy. Streamlining processes and reducing tax fraud are just two of them! Let’s look at a few more:

- More transparency: GST projects make it easier to track and analyze financial data, as every transaction is recorded and accounted for.

- Efficient tax management: GST projects simplify the process of calculating, collecting, and remitting taxes. This means fewer errors and no penalties.

- No cascading effects: GST replaces multiple indirect taxes like excise duty and VAT, so there’s no double taxation. This leads to less tax on goods and services.

- More competitiveness: GST projects help companies expand without worrying about varying tax rates or complex compliance procedures.

- Easier compliance: GST projects make tax compliance simpler with online filing of returns and automation.

- Growth boost: GST projects have been known to stimulate investment, reduce costs, attract foreign direct investment and contribute to economic development.

On top of these benefits, tech solutions can increase the effectiveness and impact of GST projects. For example, one leading retail chain saw great improvements after implementing a GST project. They experienced better tax management, lower compliance burden and improved inventory management. As a result, customer experience was improved, the business expanded and profitability increased.

Ready to explore GST project ideas? Get ready for an amazing ride!

List of Popular GST Project Ideas

Popular GST project ideas can be a great way to display your knowledge and expertise in the Goods and Services Tax area. Here are some thoughts to mull over:

- Creating a GST Calculator: Develop a user-friendly app that precisely computes GST for different services and products.

- GST Billing System: Design an extensive billing system that robotizes the process of producing GST-compatible invoices.

- GST Reporting Dashboard: Construct an easy-to-understand dashboard that provides real-time information about GST data, helping businesses make shrewd decisions.

- GST Compliance Tool: Develop a software solution that assists businesses in achieving compliance with GST regulations through automated tests and reminders.

- GST Data Analytics: Utilize data analytics tactics to examine large sets of GST data, recognizing designs, oddities, and trends for better compliance and decision-making.

In addition, investigating novel project ideas such as exploiting artificial intelligence or machine learning algorithms to advance GST procedures could also be an appealing option to pursue.

In the past few years, the implementation of the Goods and Services Tax has had a major effect on India’s economy. Deloitte research reveals that the introduction of GST has helped harmonize taxation procedures, cut out multiple indirect taxes, and spurred economic growth.

Bear in mind, when deciding on a project idea, ponder your interests, abilities, and resources available. Taking on a popular GST project endeavor can not only boost your technical capabilities but also make a contribution to resolving real-world issues caused by this crucial tax reform.

These studies of successful GST projects will have you swiping right on revenue and leaving a trail of triumphs in taxes.

Case Studies of Successful GST Projects

A table can show us key success details. Overview:

| Project Name | Industry | Benefits |

|---|---|---|

| Project 1 | Manufacturing | Transparency & reduced tax evasion |

| Project 2 | E-commerce | Streamlined supply chain & compliance |

| Project 3 | Logistics | Simplified interstate ops & efficiency |

For unique aspects, in manufacturing, one project tackled challenges. Leveraging GST, it grew by ensuring transparency and curbing tax evasion.

In e-commerce, one org used GST to optimize. Result: improved efficiency & compliance with tax regulations.

These case studies inspire businesses across sectors. Implementing GST has transformed operations & yielded great benefits.

Trying to solve a GST project is like a Rubik’s Cube – challenging, confusing & frustrating, but it keeps us entertained!

Challenges and Solutions in Implementing GST Projects

| Challenges | Solutions |

|---|---|

| Compliance complexities | Automation tools & software |

| Data integration | Seamless data migration & API integration |

| System compatibility | Extensive testing & customization |

| Training requirements | Comprehensive training programs |

Apart from the challenges, unique details may arise. Robust security protocols and periodic audits are key. Working with legal experts can ensure adherence to guidelines.

For smoother implementation, use a phased approach. This enables gradual adaptation and better user adoption.

Clear communication channels are essential. Have regular meetings and updates to keep everyone on the same page.

Follow these suggestions to navigate complexities with ease. Prioritize collaboration, planning, and constant evaluation for successful outcomes. The future of GST project ideas is bright!

Frequently Asked Questions

1. What are some innovative GST project ideas for beginners?

Some innovative GST project ideas for beginners include developing a GST billing software, creating a GST filing and compliance tracker, building a GST tax calculator app, designing a GST invoicing system, developing a GST registration portal, and creating a GST return filing platform.

2. How can I create a GST billing software project?

To create a GST billing software project, you can use programming languages like Python, Java, or C# with a user-friendly interface. Include features like invoice generation, product catalog management, GST calculation, and integrated payment options to make it comprehensive and functional.

3. What are the benefits of developing a GST filing and compliance tracker project?

A GST filing and compliance tracker project can help businesses ensure timely and accurate GST filings, avoid penalties, and maintain regulatory compliance. It provides a centralized platform to manage GST-related activities, track deadlines, generate reports, and streamline the entire GST filing process.

4. Is it possible to develop a GST tax calculator app for mobile devices?

Yes, it is possible to develop a GST tax calculator app for mobile devices. You can use mobile app development frameworks like React Native, Flutter, or Xamarin to create cross-platform apps compatible with both Android and iOS devices. Include features like different tax slabs, item-wise calculation, and real-time updates for accurate calculations.

5. How can I design a GST invoicing system project?

To design a GST invoicing system project, you can use web development technologies like HTML, CSS, and JavaScript. Include features like invoice generation with GST details, client and product database management, tax calculation, and PDF generation for professional-looking invoices.

How Can Hbase Projects Ideas be Revolutionizing for My Project?

Looking to revolutionize your project? Explore the potential of innovative HBase project ideas. These ideas can transform your project by leveraging the power of HBase, a highly scalable and distributed NoSQL database. Whether it’s real-time analytics, stream processing, or large-scale data storage, HBase projects offer robust solutions that can take your project to the next level. Embrace the possibilities and embrace success. Revolutionize with innovative hbase project ideas.

6. What are the key features to consider while developing a GST return filing platform?

While developing a GST return filing platform, consider key features such as user authentication, secure data storage, GSTIN verification, data import/export functionality, auto-population of return forms, GST reconciliation, and error detection and correction mechanisms for accurate and efficient return filing.

Conclusion

As technology and globalization rise, so do the possibilities for GST project ideas. Streamlining taxes, increasing compliance, and leveraging technologies such as AI and blockchain can make operations simpler, reduce errors, and boost efficiency.

It’s crucial for GST projects to keep up with digitalization. Automation and data analytics tools can analyze data and provide real-time insights. E-invoicing systems and online authentication can increase transparency and reduce tax evasion. These advancements promise a bright future for GST projects.

Collaboration between governments is also essential. Sharing best practices and standardizing frameworks globally can improve cross-border trade, reduce double taxation, and harmonize tax codes. This would benefit international businesses and promote economic growth.

Change management strategies are necessary for success. Stakeholder engagement, training programs, and evaluations are key. With proper planning and execution, GST projects can make taxation easier across borders.

Deloitte’s “Digital Transformation & Tax Administration” report shows that digitalization can save governments money and improve taxpayer compliance. Technology-driven solutions are thus essential for an efficient tax system.

GST project ideas can revolutionize taxation with the right technology, collaboration, and change management strategies. Governments, businesses, and innovators must make the most of this chance for a fairer and more efficient tax system.

References:

Also Read: